End of an Era: Will Transaction Fees Eat Up All the Bitcoin?

As of 2023, one billion Bitcoins have been mined. The question on everyone’s mind is, is this the end of the world as we know it – will transaction fees eat up all these newly minted coins?

Understanding Mining and Transaction Fees

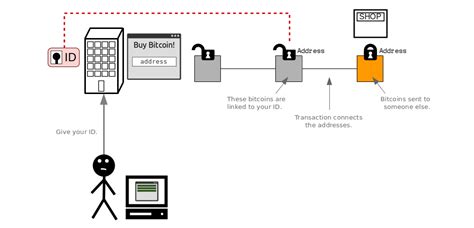

To put things into perspective, miners are incentivized to validate transactions by receiving a certain number of new Bitcoins in exchange for their work. This process is known as mining. The more complex the transaction, the more difficult it is to validate, which means the miners have to expend more computing power and energy.

Transaction fees, on the other hand, are a fee charged by the network when a user sends or receives Bitcoin. These fees act as a sort of “fee” for the miners who used their processing power to validate the transactions. The fees are paid in Bitcoin, which is the native cryptocurrency of the Ethereum blockchain.

Can transaction fees consume all Bitcoins?

At first glance, it may seem that transaction fees shouldn’t consume all newly minted Bitcoins. After all, there is a limited supply of coins – only 21 million will ever be created. However, consider this: even if new Bitcoins are mined at an incredible rate, the total amount of transaction fees generated could exceed the creation of new coins.

Imagine a scenario where miners start mining transactions with an unprecedented level of efficiency. The more complex and time-consuming the validation of each transaction is, the higher the fee that will be charged. This would lead to a situation where the cost of transactions increases exponentially, making it almost impossible for users to buy or sell Bitcoin at reasonable prices.

The Energy Consumption Conundrum

Another factor to consider is the energy consumption associated with mining. The process requires massive amounts of electricity, which can have significant environmental and financial implications. As the number of miners increases, so does the strain on the global energy grid.

In 2020, a study estimated that the energy required to mine just one block of Bitcoin would be equivalent to powering over 250 million households for an entire year. This highlights the scale of the problem and underscores the need for sustainable alternatives.

Ethereum Solution: Scaling

To alleviate the transaction fee problem, Ethereum has been working to scale its network through various mechanisms, including:

- Sharding: Dividing the blockchain into smaller segments or shards that can process transactions more efficiently.

- Off-chain transactions: allowing users to make transactions without sending them directly to the main blockchain, reducing the load on the network.

- Level 2 scaling solutions: such as Optimism and Arbitrum, which allow for faster and cheaper off-chain transactions.

Conclusion

While it is true that transaction fees were a thorn in the side of early Bitcoin users, they are unlikely to become the sole determinant of total coin supply. Ethereum’s solution, combined with advances in scaling technologies and more efficient energy management, will help alleviate the problem.

As we continue to explore new ways to use blockchain technology, it is essential to consider the long-term implications of transaction fees on our ecosystem. While it may seem daunting, the journey towards a more sustainable and efficient cryptocurrency network is underway – and one that could ultimately benefit all users involved.